Are you looking to unlock international opportunities through real estate investments in overseas properties as a non-U.S. citizen? Well, there’s something known as foreign national mortgages, or foreign national loans, that allow you to tap into the U.S. real estate market, even if you’re not a citizen. In this comprehensive guide, we’ll detail the types of U.S. real estate investment opportunities and all about foreign national loans and how to secure funding.

Investment Opportunities in The U.S. Real Estate Market

Diving into the U.S. real estate market opens up a world of possibilities for international investors, each bursting with its own unique benefits and potential rewards. Getting to grips with the variety and scale of these opportunities is key to making choices that feel right for you.

- Residential Properties: Imagine owning a cozy single-family home or a building filled with bustling apartments. The U.S. housing scene is incredibly diverse, offering everything your heart might desire. Investing in residential areas could not only secure you a steady stream of rental income but also the chance to see your investment grow in value, particularly in sought-after city or suburban spots.

- Commercial Real Estate: Step into the world of towering office buildings, vibrant retail spaces, warehouses buzzing with activity, and sprawling industrial complexes. Venturing into commercial properties might bring higher returns compared to residential investments, though it’s a path that comes with its own set of challenges and a bigger initial financial leap.

- Vacation Rentals: There’s something quite enchanting about owning a property in a holiday hotspot. These gems can be real moneymakers, especially during the tourist season, offering juicy rental yields. But remember, such properties often need you to roll up your sleeves for some hands-on management and marketing magic.

- Development Projects: Getting involved in real estate development projects can be exhilarating for those who dream big, offering impressive returns. Whether it’s breathing life into residential areas or shaping city skylines with commercial masterpieces, these ventures are for the bold, requiring a hefty investment and a heart ready to face the risks.

Now, if you need more time to invest in overseas properties, you must understand all about the financing involved.

Foreign National Mortgages: Overview and Eligibility

A foreign national mortgage offers a pathway for international investors to buy U.S. properties without the residency status typically required by traditional mortgages. Qualifying for this type of mortgage hinges on specific criteria, including a viable credit score, a substantial down payment (often 30% or more), and proof of income or assets. Unlike standard mortgages, the requirements and terms for foreign national mortgages can vary significantly between lenders, highlighting the need for thorough research and preparation by prospective buyers.

Eligibility Criteria for International Buyers

Now, eligibility requirements for foreign national mortgages may be more stringent compared to conventional loans, and borrowers may need to provide extensive documentation to prove their creditworthiness and ability to repay the loan.

Credit Score and Financial History

Prospective borrowers typically need to demonstrate financial stability and creditworthiness. For those without a U.S. credit history, international credit reports, or evidence of financial responsibility in their home country, can sometimes be used as a substitute.

Down Payment and Proof of Income

Foreign national mortgages often require higher down payments compared to traditional loans, sometimes as much as 30% to 40% of the purchase price. Proof of income, whether from domestic or international sources, is also necessary to assure lenders of the borrower’s ability to repay the loan.

Documents Needed for Foreign National Mortgage Approval

In order to secure approval for a foreign national mortgage, borrowers are typically required to provide certain documentation. These requirements typically include a valid passport and visa to establish their identity and legal status in the country. Additionally, employment verification is necessary to demonstrate income stability.

It’s important for international investors to carefully follow the specific guidelines provided by lenders and provide all requested documents in a timely manner to ensure a smooth loan approval process.

Foreign National Mortgages: Benefits and Challenges

Foreign national mortgages offer several benefits for international investors in the U.S. real estate market. These loans provide the opportunity to purchase property and finance residential investment properties.

However, foreign national borrowers may also face eligibility requirements and documentation challenges.

Benefits of Foreign National Mortgages

- Accessibility to the U.S. Market: One of the most significant advantages is the door it opens for non-U.S. residents to invest in one of the world’s most dynamic real estate markets. This accessibility is crucial, considering the stringent regulations and financial barriers that can otherwise deter international investments.

- Diverse Investment Opportunities: With a foreign national mortgage, investors gain the flexibility to explore a wide array of properties across the U.S., from cozy apartments in bustling cities to sprawling commercial spaces in emerging neighborhoods. This diversity allows for tailored investment strategies that align with individual goals and market insights.

- Potential for High Returns: The U.S. real estate market is known for its resilience and potential for capital appreciation. Foreign national mortgages enable investors to leverage these opportunities, potentially leading to significant returns on investment through rental income and property value increases.

- Leverage Advantage: Investing with a mortgage allows for leverage—using borrowed capital to increase the potential return of an investment. This means investors can maintain liquidity and allocate their resources across multiple investments, enhancing their portfolio’s diversification and potential returns.

Challenges of Foreign National Mortgages

- Higher Down Payment Requirements: To mitigate the perceived risk of lending to non-residents, lenders often require foreign nationals to make a larger down payment, sometimes as much as 30-40% of the property’s purchase price. This upfront cost can be a significant barrier for some investors.

- Interest Rates and Fees: Foreign national mortgages may come with higher interest rates and additional fees, reflecting the lenders’ risk assessment of lending to non-U.S. citizens. These increased costs can impact the overall profitability of the investment.

- Regulatory and Legal Hurdles: International investors must navigate the U.S. regulatory environment, which can include everything from understanding property ownership laws to managing tax implications. These legal and regulatory aspects require diligent research and often the guidance of legal and financial professionals.

- Property Management Considerations: For investors not residing in the U.S., managing a property from afar presents its challenges. Ensuring the property is well-maintained, managing tenant relationships, and adhering to local property laws require careful planning and, often, the engagement of professional property management services.

How to Qualify for a Foreign National Mortgage

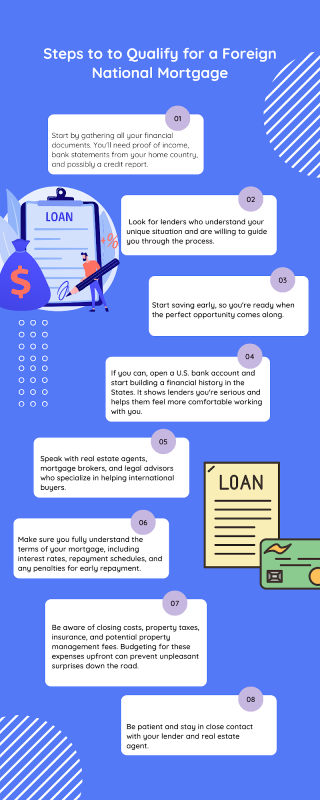

Securing a foreign national mortgage in the U.S. can feel like navigating a maze, but it’s entirely possible with the right approach and mindset. Here are some friendly tips to guide you through the process, making it a bit more approachable and less daunting:

- Get Your Ducks in a Row: Start by gathering all your financial documents. You’ll need proof of income, bank statements from your home country, and possibly a credit report. Think of it as packing for a long trip; you want to make sure you have everything you might need.

- Research Lenders Like You’re Dating: Not all lenders are experienced with foreign national mortgages, so it’s essential to shop around. Look for lenders who understand your unique situation and are willing to guide you through the process. It’s like finding the right partner; you want someone who gets you.

- Save Up for a Rainy Day: Foreign national mortgages often require a higher down payment, sometimes 30% or more of the property’s value. Start saving early, so you’re ready when the perfect opportunity comes along.

- Build a Financial Footprint in the U.S.: If you can, open a U.S. bank account and start building a financial history in the States. It shows lenders you’re serious and helps them feel more comfortable working with you. Think of it as making new friends in a new city; it takes effort but pays off.

- Consult the Pros: Don’t go at it alone. Speak with real estate agents, mortgage brokers, and legal advisors who specialize in helping international buyers. They’re like your local guides in a foreign city, helping you navigate the local customs and language.

- Understand the Fine Print: Make sure you fully understand the terms of your mortgage, including interest rates, repayment schedules, and any penalties for early repayment. It’s like reading the terms and conditions before clicking “accept”—tedious, but necessary.

- Prepare for Additional Costs: Be aware of closing costs, property taxes, insurance, and potential property management fees. Budgeting for these expenses upfront can prevent unpleasant surprises down the road. It’s akin to checking the weather before a trip; it’s always better to be prepared.

- Patience Is Key: The process might take longer than a standard mortgage application. Be patient and stay in close contact with your lender and real estate agent. Think of it as planting a garden; it takes time for things to grow, but the results are worth the wait.

Tips For Securing A Foreign National Mortgage

Finding Lenders Specializing in Foreign National Mortgages

When looking for lenders specializing in foreign national mortgages, it’s crucial to research thoroughly and find those with expertise in working with international investors.

Look for lenders who have experience navigating the specific requirements and processes involved in foreign national financing. It’s also beneficial to seek recommendations from other international investors or consult with professionals in the field who can provide guidance and help connect you with the right lenders.

Choosing a Real Estate Agent experienced with International Investors

When it comes to purchasing property in a foreign country, it’s crucial to work with a real estate agent who is experienced with international investors. These agents have a deep understanding of the unique challenges and considerations that foreign national investors face.

They can provide valuable guidance on local market conditions, legal requirements, and investment strategies tailored to the needs of international buyers.

By choosing an agent with this expertise, international investors can navigate the complex real estate landscape with confidence and maximize their investment opportunities.

Final Thoughts on Foreign National Mortgages & Investing in Overseas Properties

Securing a foreign national mortgage serves as a gateway for international investors to access the wealth of opportunities within the U.S. real estate market. By understanding foreign national mortgages and your options, you can potentially invest in the U.S. real estate market and generate returns. Remember, it’s important to conduct your due diligence before jumping into any real estate deal and securing a loan as a non-U.S. citizen.

Discover more from Futurist Architecture

Subscribe to get the latest posts sent to your email.