A Home Equity Line of Credit (HELOC) is typically issued by financial institutions such as banks, credit unions, and mortgage companies. These lenders provide homeowners with a revolving line of credit based on the equity they have built up in their homes. The process involves an application and approval stage, where the lender assesses the applicant’s creditworthiness, the home’s value, and other financial factors to determine eligibility and the credit limit.

The structure of a HELOC consists of two main phases: the draw period and the repayment period. During the draw period, which usually lasts 5 to 10 years, borrowers can access funds up to their credit limit as needed. Interest rates during this phase are generally variable. Once the draw period ends, the repayment period begins, usually lasting 10 to 20 years. During this time, borrowers can no longer draw funds and must start repaying both the principal and interest.

One of the primary benefits of a HELOC is its flexibility. Borrowers can use the funds for various purposes, such as home improvements, educational expenses, or debt consolidation. The interest rates are often lower than those of credit cards or personal loans, making it a more cost-effective way to borrow. In some cases, the interest paid on a HELOC may also be tax-deductible if used for qualifying home improvements.

However, a HELOC comes with its set of risks. The variable interest rates mean that payments can increase, sometimes significantly. Also, because your home serves as collateral, failure to make timely payments could result in foreclosure. There may also be fees associated with opening and maintaining the line of credit, which can add to the overall cost.

Given these pros and cons, a HELOC can be a valuable financial tool when used responsibly. If you’re considering one, it’s crucial to understand all the terms and conditions, and possibly consult with financial advisors to ensure it aligns with your financial goals.

Table of Contents

How Do I Know I’m Qualified for a HELOC?

Determining your eligibility for a Home Equity Line of Credit (HELOC) involves a combination of factors that lenders will assess before approving your application. While each lender may have specific criteria, there are some general guidelines that can help you gauge your qualification status.

Credit Score

One of the first things lenders look at is your credit score. A good credit score not only increases your chances of being approved but also can secure you a lower interest rate. Generally, a credit score of 680 or higher is considered favorable, although some lenders may approve scores as low as 620.

Home Equity

The amount of equity you have in your home is a critical factor. Equity is calculated by taking the current market value of your home and subtracting the amount you owe on your mortgage. Most lenders require that you have at least 15-20% equity in your home, although some may require more.

Debt-to-Income Ratio

Lenders will assess your debt-to-income (DTI) ratio, which is a measure of your monthly debt payments relative to your monthly income. A lower DTI ratio is preferable, as it indicates you have a good balance between debt and income. Many lenders look for a DTI ratio below 43%.

Stable Income

Having a stable and reliable income can significantly improve your chances of being approved for a HELOC. Lenders may ask for recent pay stubs, tax returns, or other financial documents to verify your income. Self-employed individuals may need to provide additional documentation to prove their income stability.

Property Value and Condition

The lender will likely require an appraisal of your property to determine its current market value. The condition of your home can also impact your eligibility. Homes that are well-maintained are generally more favorable in the eyes of lenders.

Understanding Interest Rates in HELOCs

Interest rates are a crucial component of any financial product, including loans, credit cards, and savings accounts. They serve as the cost of borrowing money or, conversely, the reward for saving money. In the context of a Home Equity Line of Credit (HELOC), the interest rate is the cost you pay to borrow against the equity in your home.

Types of Interest Rates

- Fixed Interest Rate: This type of rate remains constant over the life of the loan or during a specified period. Fixed rates provide predictability in monthly payments but are generally higher than initial variable rates.

- Variable Interest Rate: Also known as adjustable rates, these can change over time based on market conditions. Most HELOCs come with variable interest rates that are tied to an index, like the prime rate, plus a margin determined by the lender.

Factors Affecting Interest Rates

Several factors can influence the interest rate you receive on a HELOC:

- Credit Score: A higher credit score can help you secure a lower interest rate.

- Loan-to-Value Ratio (LTV): This is the percentage of your home’s value that you’re looking to borrow. A lower LTV often results in a lower interest rate.

- Economic Conditions: Broader economic factors, like the federal funds rate, can also impact interest rates.

Rate Caps

It’s essential to understand if your HELOC has a rate cap, which limits how much the interest rate can increase over a specific period or over the life of the loan. This can offer some protection against rising interest rates.

Impact on Payments

The interest rate will directly affect your monthly payments. A higher rate means you’ll pay more in interest over the life of the loan, making it more expensive. Conversely, a lower rate will result in lower monthly payments, making the loan more affordable in the long run.

The HELOC Calculator

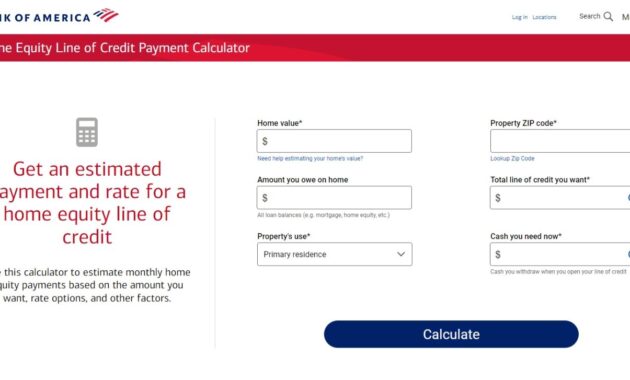

A Home Equity Line of Credit (HELOC) calculator is an invaluable tool for anyone considering tapping into their home’s equity. This calculator helps you estimate various aspects of a HELOC, such as the credit limit you might qualify for, the monthly payments during the draw and repayment periods, and the total cost of the loan including interest. Here’s how a HELOC calculator can guide you through the decision-making process.

How It Works

A HELOC calculator typically requires you to input specific data, such as your home’s current value, your outstanding mortgage balance, and the lender’s terms, including interest rates. Based on these inputs, the calculator will provide you with an estimate of how much you can borrow, what your monthly payments could be, and how those payments might change over time, especially if you have a variable interest rate.

Benefits of Using a HELOC Calculator

- Budget Planning: Knowing your potential monthly payments helps you assess whether a HELOC fits into your budget.

- Comparison: You can compare different scenarios, such as how varying interest rates or loan amounts affect your payments and total loan cost.

- Informed Decision: The calculator provides a clearer picture of the financial commitment involved, aiding you in making an informed decision.

Limitations

While a HELOC calculator is a useful tool, it’s essential to remember that the results are estimates. Factors like changing interest rates, fees, and individual lender policies can affect the actual numbers. Therefore, it’s advisable to use the calculator as a starting point and consult with financial professionals for a more comprehensive analysis.

Where to Find a HELOC Calculator

Many financial institutions and personal finance websites offer free HELOC calculators. These online tools are user-friendly and can be accessed at any time, providing you with the flexibility to explore various scenarios at your convenience. You can try the tools from Bank of America or US Bank.

A Case Study

John, a homeowner, has a house appraised at $200,000 and is interested in obtaining a Home Equity Line of Credit (HELOC) for $70,000 to fund his daughter’s college education. This case study explores the financial implications, benefits, and risks associated with his decision to tap into his home’s equity.

Current Financial Situation

- Home Value: $200,000

- Outstanding Mortgage: $100,000

- Equity: $100,000

- Desired HELOC Amount: $70,000

- Credit Score: 720

- Debt-to-Income Ratio: 35%

HELOC Terms

After shopping around, John finds a lender offering a HELOC with the following terms:

- Interest Rate: Variable, starting at 4.5%

- Draw Period: 10 years

- Repayment Period: 15 years

- Rate Cap: 2% annually, 6% lifetime

Financial Analysis

Using a HELOC calculator, John estimates his monthly interest payments during the draw period to be approximately $262.50 at the starting rate of 4.5%. This fits comfortably within his budget. However, he also considers the rate cap and calculates that his monthly payment could go up to around $420 if the rate increases to the lifetime cap of 10.5%.

Benefits and Risks

Benefits:

- Flexibility: John can draw the $70,000 as needed for tuition payments over several years, reducing the interest accrued compared to taking a lump sum.

- Lower Interest Rate: At 4.5%, the HELOC offers a lower interest rate than most private student loans.

- Tax Benefits: The interest may be tax-deductible since it’s used for educational purposes, although John should consult a tax advisor for confirmation.

Risks:

- Variable Rate: The interest rate can increase, affecting his monthly payments.

- Home as Collateral: Failure to repay could result in the loss of his home.

- Impact on Credit Score: A high balance relative to the credit limit could negatively impact John’s credit score.

Conclusion

For John, a HELOC appears to be a financially viable option for funding his daughter’s education, given the lower interest rates and potential tax benefits. However, he must be prepared for the possibility of rising interest rates and ensure timely repayments to mitigate the risks involved. Consulting with financial and tax advisors is recommended for a comprehensive understanding of his obligations and benefits.

FAQs

A Home Equity Line of Credit (HELOC) can be a complex financial product with various nuances. While we’ve covered the basics, eligibility, and interest rates, there are still many questions that potential borrowers might have. Below are some frequently asked questions that delve into less commonly discussed aspects of a HELOC.

Can I Use a HELOC for Investment Properties?

Yes, some lenders offer HELOCs on investment properties, although the terms may be less favorable than those for a primary residence. The interest rates are generally higher, and you may need a lower loan-to-value ratio to qualify.

What Happens to My HELOC If I Sell My Home?

When you sell your home, the HELOC must be paid off using the proceeds from the sale. Any remaining funds after paying off your first mortgage and the HELOC are yours to keep. It’s crucial to coordinate with your lender to ensure the loan is closed properly.

Can I Convert My HELOC to a Fixed-Rate Loan?

Some lenders offer a “conversion feature” that allows you to convert a portion or all of your variable-rate HELOC to a fixed-rate loan. This can be beneficial if you expect interest rates to rise, but there may be fees associated with this conversion.

Is It Possible to Refinance a HELOC?

Yes, you can refinance a HELOC, much like you would a traditional mortgage. Refinancing could help you secure a lower interest rate, extend the draw period, or switch to a loan with more favorable terms. However, refinancing often comes with fees and may require a new home appraisal.

Are There Alternatives to a HELOC?

Yes, there are several alternatives to consider. A home equity loan, also known as a “second mortgage,” provides a lump sum at a fixed interest rate. Personal loans and cash-out mortgage refinancing are other options, each with their own pros and cons.

Can I Have Multiple HELOCs on the Same Property?

It’s technically possible to have more than one HELOC on the same property, but it’s rare and not all lenders allow it. If they do, the second HELOC would be subordinate to the first, making it riskier for the lender and likely resulting in a higher interest rate.

What Happens If I Default on My HELOC?

Defaulting on a HELOC has serious consequences, including damage to your credit score and potential foreclosure on your home. If you find yourself struggling to make payments, it’s crucial to communicate with your lender as soon as possible to explore options like loan modification.

How Does a HELOC Affect My Taxes?

While the interest on a HELOC used for home improvements may be tax-deductible, the Tax Cuts and Jobs Act of 2017 changed the rules for other uses. Now, you can’t deduct the interest if you use the HELOC funds for expenses like debt consolidation or education unless it’s a business investment. Always consult a tax advisor for personalized advice.

Can I Negotiate the Terms of My HELOC?

Yes, some terms of a HELOC may be negotiable, such as the interest rate, fees, or the draw period length. However, much depends on the lender’s policies and your financial standing. It’s always a good idea to shop around and negotiate to get the best possible terms.

Is There a Minimum Draw Requirement?

Some HELOCs have a minimum draw requirement, either at the time of closing or for each transaction. This means you may have to borrow at least a certain amount initially or each time you access the funds. Make sure to check this in your loan agreement.

Can I Pay Off a HELOC Early?

Most HELOCs allow you to pay off the balance early without a prepayment penalty, but some may have a “minimum hold” period during which you can’t pay off the loan without incurring a fee. Always read the fine print to understand any restrictions on early repayment.

What Are the Common Fees Associated with a HELOC?

Apart from interest rates, you may encounter various fees such as application fees, annual fees, and transaction fees. Some lenders may also charge an inactivity fee if you don’t use your HELOC for an extended period.

How Does a HELOC Impact My Credit Score?

Opening a HELOC will result in a hard inquiry on your credit report, which could temporarily lower your credit score. However, responsible use and timely payments can have a positive impact on your credit over time.

Can I Freeze My HELOC?

Some lenders offer the option to freeze your HELOC under certain conditions, such as if your home’s value decreases significantly or if you experience financial hardship. Freezing the account would mean you can’t draw additional funds, but you can continue to make payments.

In conclusion, a Home Equity Line of Credit (HELOC) is a versatile financial tool that offers both opportunities and risks. It can provide the financial flexibility you need for various life events or projects, from home improvements to educational expenses. However, it’s crucial to have a comprehensive understanding of all its facets, from interest rates and fees to tax implications and repayment terms.

The FAQs and case studies discussed above aim to shed light on some of the less commonly discussed aspects of a HELOC. These insights can serve as a valuable resource in your decision-making process, helping you weigh the pros and cons based on your individual financial situation. Remember, while online tools like HELOC calculators can offer valuable preliminary insights, they are no substitute for professional financial advice.

If you’re considering a HELOC, take the time to do your research, consult with financial advisors, and read all the fine print. By being well-informed and cautious, you can make the most of what a HELOC has to offer while minimizing potential risks. Your home is not just a place to live; it’s also a financial asset that, when leveraged wisely, can help you achieve your financial goals.

Discover more from Futurist Architecture

Subscribe to get the latest posts sent to your email.